Canada’s wealthiest earners will face higher taxes to help pay for increased federal spending over the coming years.

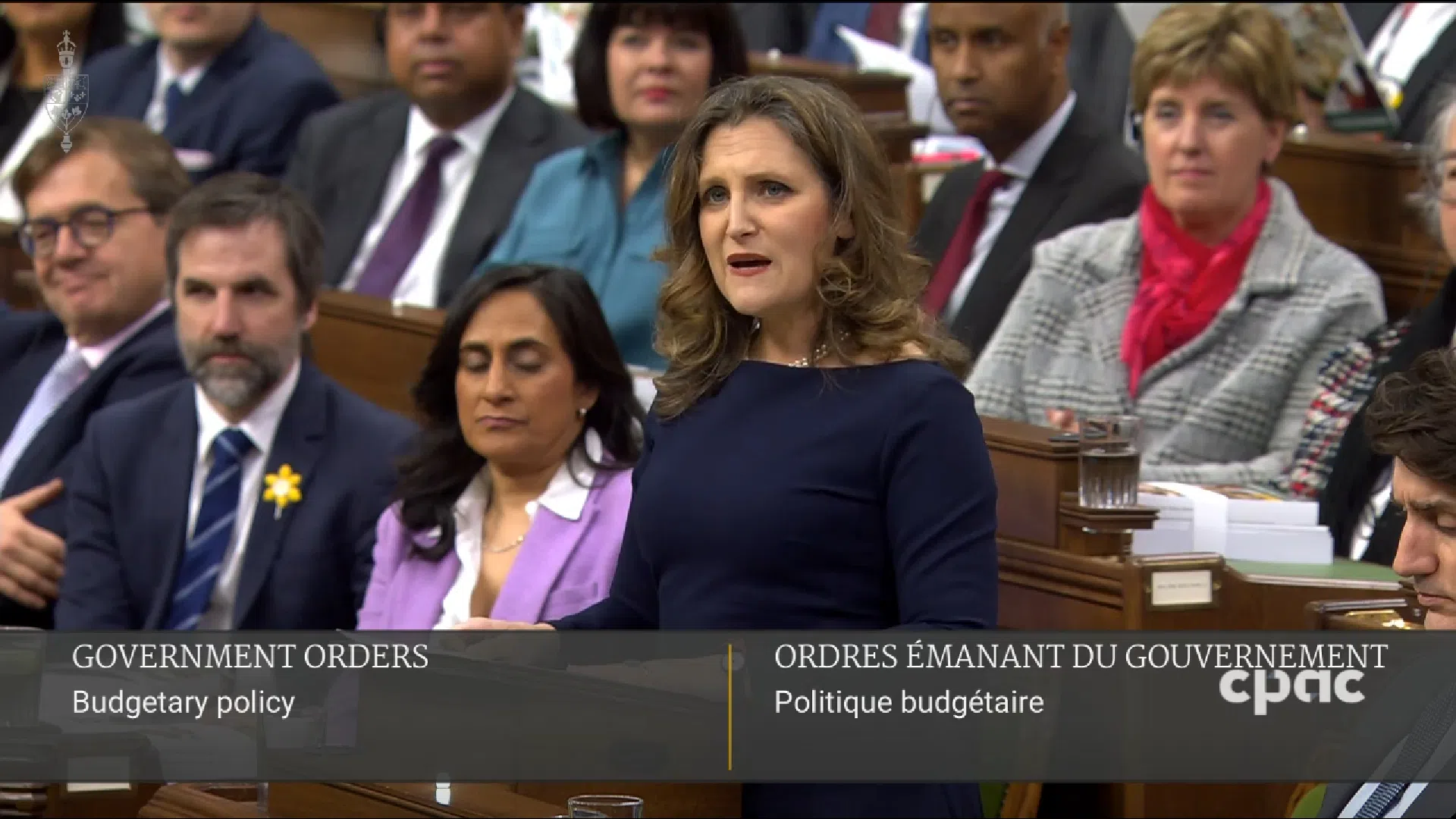

An increase to the capital gains inclusion rate is part of the 2024-25 federal budget, tabled on Tuesday afternoon.

Finance Minister Chrystia Freeland said only 0.13 per cent of Canadians will end up paying more on their capital gains.

Federal officials said the increase is expected to generate an extra $19 billion in revenue over the next five years.

“This new revenue will help make life cost less for millions of Canadians, particularly Millennials and Gen Z. It will help fund our efforts to turbocharge the building of more homes,” Freeland said in her budget speech.

Dubbed ‘Fairness for Every Generation,’ the budget lays out steps to build more homes, make life cost less, and grow the economy.

It includes a strategy to unlock nearly 3.9 million new homes by 2031 — a pace “not seen since the Second World War,” said Freeland.

The government plans to do that through several measures, including the recently announced $6 billion Canada Housing Infrastructure Fund in addition to another $400 million added to the Housing Accelerator Fund.

To help those renting, the feds will launch a Rental Protection Fund and provide $1 billion to the Affordable Housing Fund for those who cannot afford a home.

They will also make the effort to build more homes on public land, as well as support skilled trade workers and create apprenticeships.

When it comes to making life more affordable, Ottawa plans to spend $1.5 billion over five years to launch the new national universal pharmacare plan.

There is $6 billion set aside for the new Canada Disability Benefit, $1 billion for a new National School Food Program, and additional funding to help increase the number of child-care spaces.

Freeland is projecting a deficit of about $40 billion for 2024-25, falling to $20 billion by 2028-29.

Opposition leaders react

The leader of the Official Opposition said his party will vote against the budget.

Conservative Leader Pierre Poilievre described it as a “wasteful inflationary budget.”

“For the first time in a generation, we’re spending more on debt interest than on health care,” said Poilievre.

“That’s money for bankers and bondholders rather than doctors and nurses.”

Ottawa is projected to spend $54 billion to finance its debt in 2024-25, according to budget documents.

Poilievre continued to call on the New Democrats to end their support for the Liberals so there can be a “carbon tax election.”

Meanwhile, NDP Leader Jagmeet Singh said there were several things in the budget they have been calling for, such as protection for renters, a National School Food Program, and the first phase of national pharmacare.

“Let’s be absolutely clear, this would have never happened but for the fact New Democrats forced the Liberals to give this relief to Canadians, to give a bit of a break to Canadians,” Singh told reporters.

But despite some positives, the NDP leader said they do have a number of concerns with this budget.

Singh said the government ignored the chance to take on corporate greed, which he said is the major driver beind the rising cost of living.

He said they are also disappointed that the long-awaited Canada Disability Benefit will only amount to $200 per month.

“That is far too little to meet the needs of people living with disabilities,” said Singh.

Singh also raised concerns about the loss of 5,000 public sector employees, as well as the lack of a plan to address the gap in infrastructure and housing funding for Indigenous communities.

The Green Party leader, meanwhile, said they cannot support the budget as a whole, despite some individual items they wanted to see.

Elizabeth May said this budget falls far short of what her party was hoping to see from the government.

While they welcome the investment in the Canada Disability Benefit, the leader said $200 per month is not enough.

“We called for an end to legislated poverty for people with disabilities. That’s not in here,” said May.

The Green leader said she also wanted to see more of an investment in the long-awaited universal pharmacare program.