The province is asking commercial landlords to defer rent payments for businesses over the next few months.

Announced Friday, the provincial government is offering a financial program for landlords who defer rent for businesses until July, allowing businesses shut down by Covid-19 to regain some financial footing without rent payments looming over them.

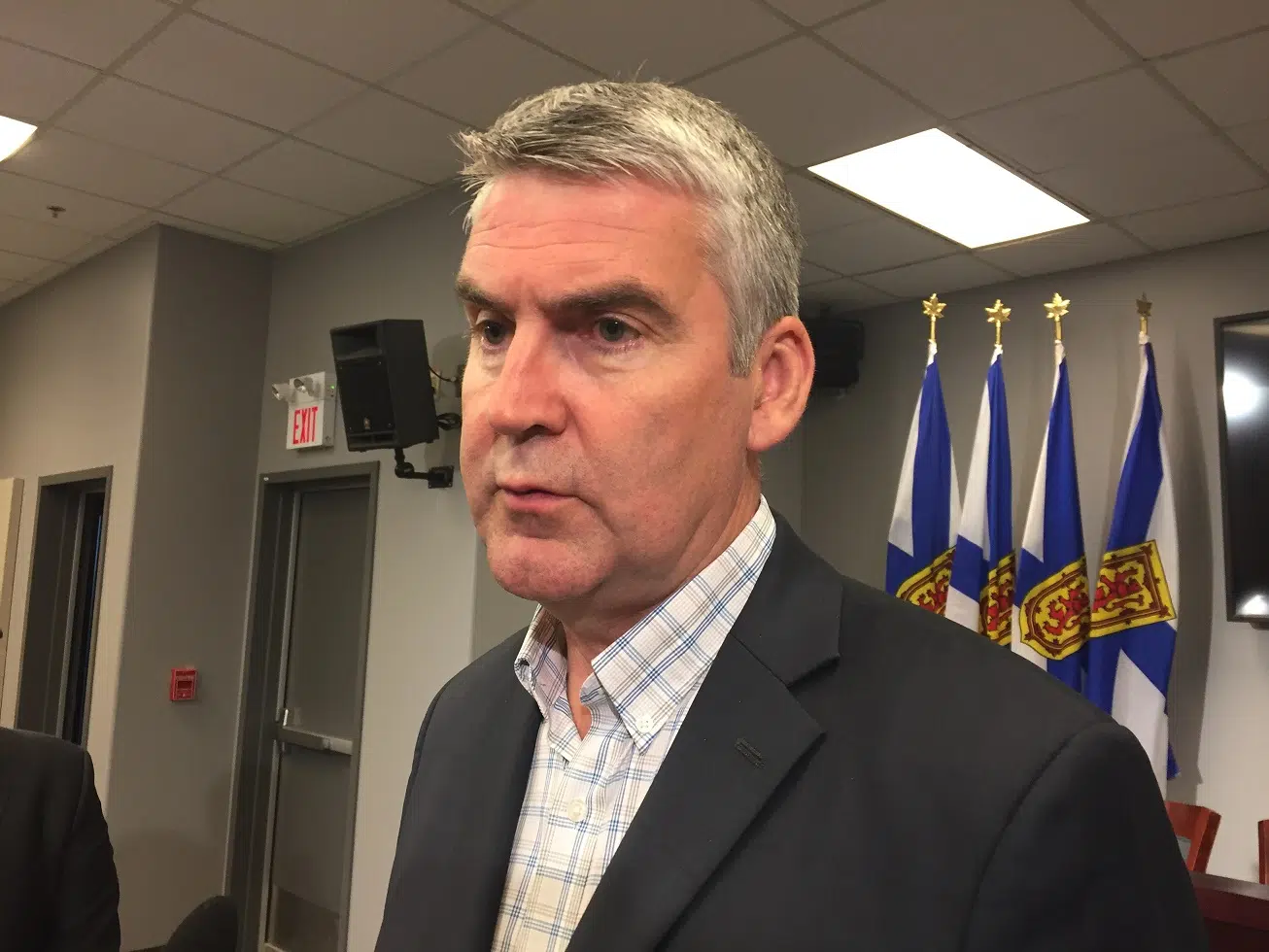

Premier Stephen McNeil said this program allows businesses time to recoup their losses without the looming threat of rent payments hanging over them, and protects landlords if payment is not made up.

“This was to insure that landlords walked in and treated their tenants with understanding that their revenue has been cut off, they need the ability to get up and get started, and they need to get their business and clientele back together,” he said.

“We’re looking to have rent deferred over the life of the tenant’s lease, which means at the end of the three months the tenant wont end up with a three month bill for rent. We expect landlords to spread that over the lifetime of the lease.”

Businesses will still be on the hook for any deferred rent payments, but for those who can’t pay, the program will cover up to $5,000 a month for three months for landlords who defer rent payments and register by April 3.

McNeil also announced landlords cannot change locks or seize property of commercial tenants who can’t pay rent if their business closed due to Covid-19.

However, Alex Pearson, co-owner of vintage clothing shop Ametora Supply in Lunenburg, said the program has completely abandoned a vast majority of small businesses in Nova Scotia, offering them no protection.

Pearson woke up Monday morning to find his shop, along with many others in the area, didn’t meet the criteria outlined in the program, meaning regardless of his financial situation, rent was due in a few days.

He said because of the government’s specifications, it could mean many Lunenburg businesses will face troubling times.

“There’s not one hint of retail on that whole thing,” said Pearson.

“Half of Lunenburg is tourist based, like souvenirs and stuff so none of those businesses would be applicable. Most of those are tiny Mom & Pop shops too.”

Outside of the oddly specific list of accepted business types, he said the program doesn’t consider the hardships rent increases to cover the deferred payments will cause for small businesses, especially with their incomes being cut for up to two months or longer.

“If you defer three months of our rent and split that over 12 months, that’s a huge rent increase,” said Pearson.

“In Lunenburg especially, we have to make 90 per cent of our money in four months. As it stands, best case scenario, we are losing two of those months this year. So now, we have two months to make 90 per cent of our money, and on top of that pay three months of rent back.”

Pearson and his wife Margaret made the choice to shut down their online store – their only income from their shop during the pandemic – to lessen the burden on postal workers.

But he says now, because of the lack of government support, he may have to put his morals aside and open it once again.